Singapore launches tender to address liabilities under EU and UK’s CBAMs

Author: Ivy Yin, Rong wei Neo

Source: S&P Global Commodity Insights

Singapore's Ministry of Trade and Industry (MTI) launched a tender on May 5 to help local companies subject to domestic carbon taxes in waiving some compliance costs under the EU and UK's Carbon Border Adjustment Mechanisms (CBAMs), according to a tender document seen by Platts, part of S&P Global Commodity Insights on May 7.

This is an important move, despite the limited direct impacts of the Carbon Border Adjustment Mechanisms (CBAMs) on Singapore. As a global trading hub and carbon service center, Singapore can assist traders handling goods from various countries in developing templates and pathways to coordinate with the EU and UK on aligning emission accounting methodologies and waiving compliance costs.

MTI invited interested tenderers to submit proposals for developing approaches that enable CBAM-imposing countries, specifically the EU and the UK, to consider Singapore's domestic carbon price. Additionally, the proposals should assess methodologies for calculating the carbon emissions embedded in Singapore's exports, the tender document said.

"There could be more jurisdictions that could impose similar measures over time," MTI said in the document.

The CBAMs introduced by the EU and UK will be implemented in 2026 and 2027, respectively. These mechanisms will impose a carbon price on emission-intensive commodities exported to their markets, equivalent to the local carbon price.

The importers will be the liable parties responsible for paying the carbon levy. However, the actual compliance costs are likely to be distributed across the supply chains of CBAM-eligible goods.

According to the document, the Consultant's appointment shall be for a maximum period of four months from the commencement date specified in the Letter of Acceptance.

The tender will close on May 29, 2025.

Factoring in Singapore's prices

Platts assessed the EU's compliance carbon price at Eur 69.34/mtCO2e ($78.70/mtCO2e) and the UK's price at GBP 50.64/mtCO2e ($67.61/mtCO2e) on May 6.

Compared to the EU and UK, most Asian countries have zero or much lower compliance carbon prices, which means that the CBAMs will sharply increase their export costs. However, Singapore's compliance carbon taxes are significantly higher compared to those of its Asian counterparts.

"Singapore's current carbon tax is S$25/mtCO2e ($19.37/mtCO2e). From 2026 onwards, this is expected to increase to S$45/mtCO2e ($34.86/mtCO2e). By 2030, Singapore's carbon tax is expected to increase to S$50-80/mtCO2e ($38.73-$61.97/mtCO2e)," MTI said in the document.

"Additionally, under Singapore's International Carbon Credits framework, carbon-tax liable companies are allowed to offset up to 5% of their taxable emissions using Article 6-compliant carbon credits," the MTI added.

"Against this backdrop, it is only reasonable that CBAM regimes factor Singapore's carbon price into their calculation of CBAM levy so that exports from Singapore are not taxed twice," MTI highlighted.

Addressing disparity

"While the EU and UK have indicated their openness to consider the carbon price paid in exporting countries when determining the final CBAM levy payable, they have not come up with a specific methodology to do so," MTI pointed out in the tender document.

"This is mainly due to the CBAM levy being computed based on emissions of specific HS product codes, whereas in Singapore's context, the carbon tax is calculated based on emissions generated at the facility level," MTI added.

MTI highlighted that the disparity in approaches between Singapore's carbon tax and the CBAM regimes could complicate the calculation of the amount to be waived from the CBAM levy imposed on importers of Singapore's goods. This situation could potentially lead to double taxation, making Singapore's exports more expensive than necessary.

MTI required the tenderers to propose solutions to address this bottleneck by developing methodologies to convert verified facility-level emissions into product-level emissions for Singapore's goods exported to the EU and the UK. "This would enable Importers to determine their share of carbon pricing for CBAM-embedded emissions and the corresponding number of CBAM certificates required," MTI explained.

Limited direct impacts

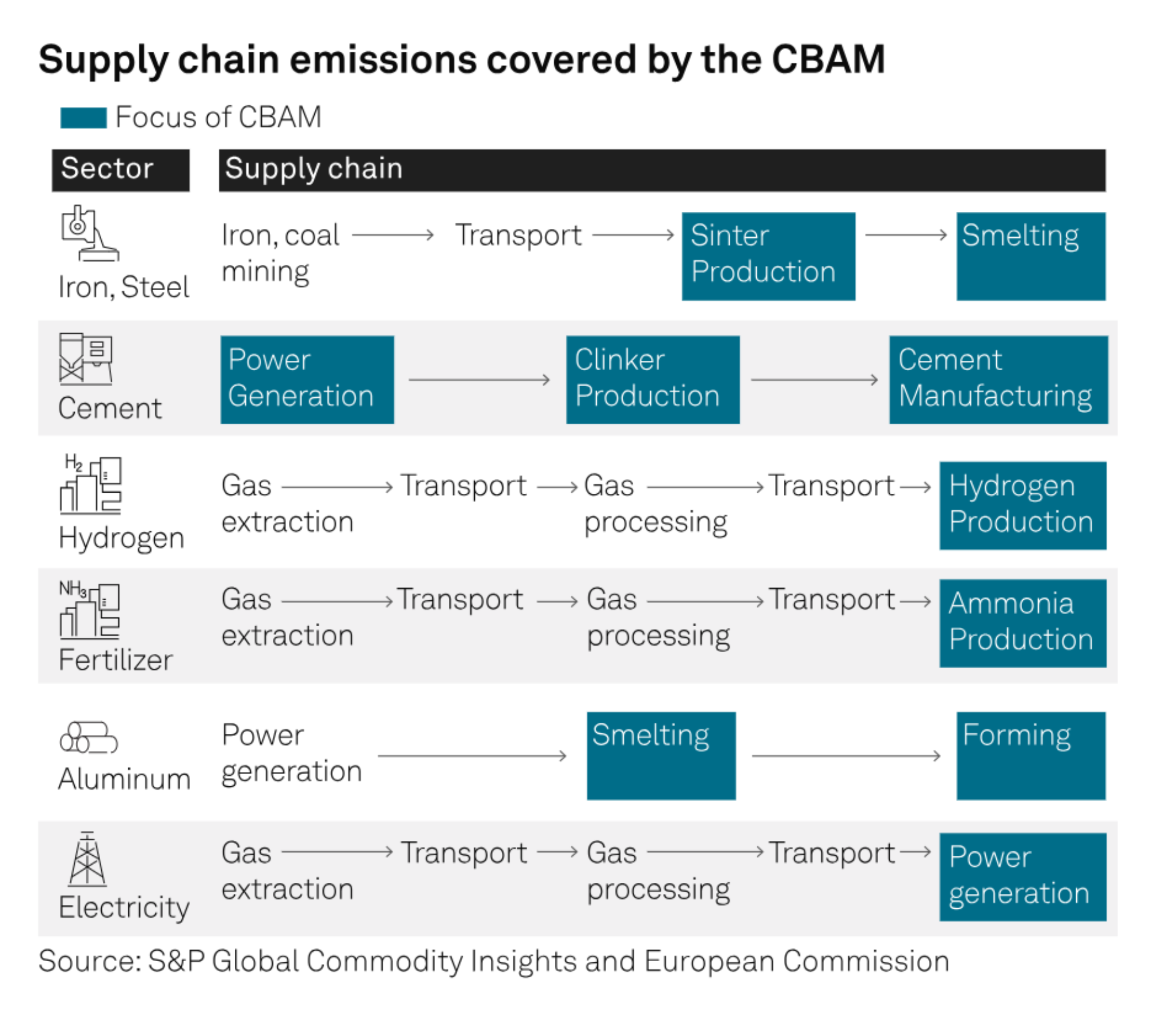

Between 2016 and 2020, the average annual value of Singapore's domestic exports to the EU was around S$19 billion, of which affected products were merely around 0.08%, or S$14 million, according to MTI's assessment in 2021 based on the EU's initial draft legislation, which covered cement, iron and steel, aluminum, fertilizers, and electricity exports to the EU.

The finalized CBAM also includes hydrogen. However, its current impact on Singapore remains negligible due to the challenges of long-distance hydrogen transportation, which hinders the scaling of international trade.

Similarly, Singapore's direct exports of CBAM-liable commodities to the UK, including aluminum, cement, ceramics, fertilizer, glass, hydrogen, iron and steel, have also been very limited.

MEMBERSHIP

Unlock exclusive access to a wealth of resources with our World Hydrogen Leaders membership. Enjoy more articles like this, over 100 annual online events, regional hydrogen intelligence updates, industry reports, news, and much more.